I recently saw a post from a former CEO that I completely agree with. He was always the G.O.A.T. of short and powerful thought considerations.

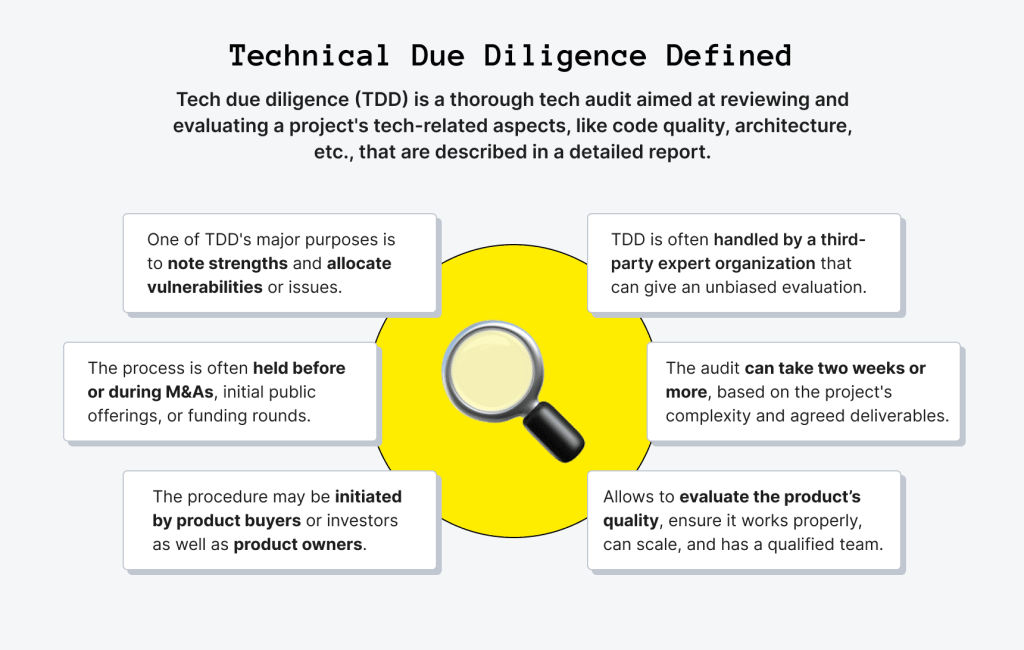

Tech diligence can’t be an afterthought in new software deals. It’s probably on equal footing with financial diligence now. It’s certainly more necessary now than ever to manage downside models.

This isn’t just a sharp observation, it’s a fundamental shift in how smart money thinks about software investments. Here’s why it matters.

(“Equal footing with financial diligence”) Tech diligence now shares the throne with financial diligence. For decades, investors led with financials and market opportunity. Tech was a checkbox exercise. But modern software—cloud-native architectures, AI integration, cybersecurity exposure, regulatory compliance—has grown too complex to treat as secondary. A crumbling tech foundation will collapse even the most attractive P&L. The math doesn’t matter if the machine can’t run.

(“More necessary than ever”) The stakes have never been higher. Capital is tighter. Risk tolerance is lower. Post-pandemic corrections, higher interest rates, and a wave of distressed SaaS deals have reminded investors that “growth at all costs” religion doesn’t work if the underlying tech is fragile or unscalable. Investors learned the hard way that hockey-stick projections mean nothing when your infrastructure is a tangled web or your security posture invites catastrophe.

(“Downside protection”) This is about survival, not just upside. The real insight that businesses need to actively stress-test the “what if things go wrong” scenarios. Rigorous tech diligence exposes the hidden killers: technical debt that will cost millions to unwind, vendor lock-in that destroys optionality, sloppy data governance that invites regulatory penalties, brittle systems that buckle under load. These aren’t hypotheticals, they’re landmines. Tech diligence maps the minefield before you step in it.

The market has already moved. Top-tier PE firms and VCs now bring CTOs and senior technical advisors to the table from day one. They’re running code reviews, stress-testing architectures, and evaluating engineering culture before term sheets get signed. Software isn’t being analyzed like a product anymore, it’s being underwritten like infrastructure. Because that’s what it is.

The bottom line for you

In Q3 2025, your technology isn’t a support function. It is the business. The code is the asset. The architecture is the moat. The team is the engine. So if you’re still treating tech diligence as an afterthought, you’re not managing risk, you’re courting it.

Leave a Reply

You must be logged in to post a comment.